Defined Benefit Cash Balance Plans: Powerful Tax Strategy for Physician Practices and Entrepreneurs

- Nisha Mehta, MD

- Aug 2, 2024

- 12 min read

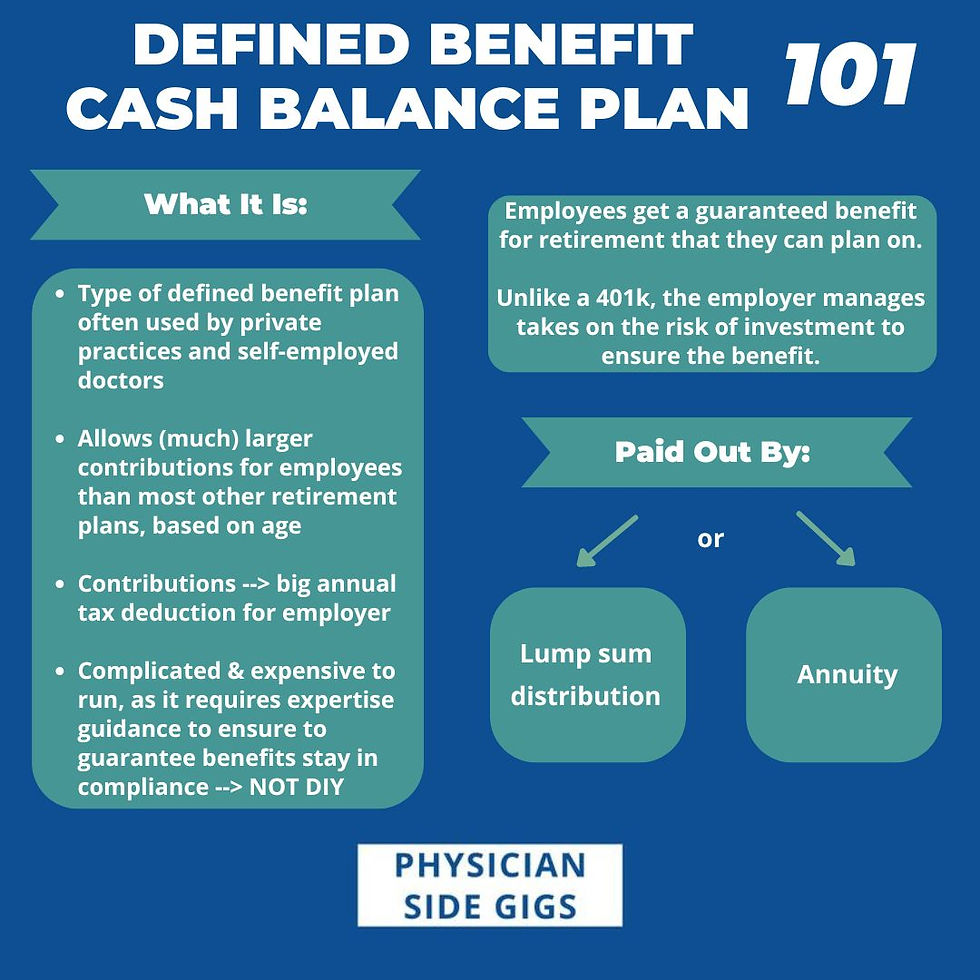

Because of their high income and tax brackets, physicians are often looking for legal vehicles for saving money on taxes. For doctors who are in private practice or have self-employed income such as physician entrepreneurs or 1099 earners, one suggestion that comes up a lot in discussions about tax strategy in our physician communities is the defined benefit plan. More specifically, when people reference the defined benefit plan, they are often referring to a subset of defined benefit plans referred to as the cash balance plan. These plans offer the opportunity to put a large amount of additional money (sometimes in the hundreds of thousands of dollars a year range) towards retirement in pre-tax dollars that can grow in a tax advantaged and asset protected way. This also reduces your taxable income for the year, and the amount you can contribute, though based on age, is usually above and beyond traditional retirement plan options such as a 401k or profit sharing plan. This article will explain what a cash balance defined benefit plan is, who can use it, the pros and cons of cash balance plans, and how to decide if it’s a good fit for you.

Disclaimer: Please note that these are incredibly complex plans with lots of nuances, whose rules are always changing, and we are not accountants. As always, you should consult appropriate expertise before taking action based on this content, which is not individualized to your personal situation and can not be guaranteed to be accurate or up to date. While we have attempted to explain this to the best of our ability, this is information that can be misinterpreted or unclear. It is only intended to introduce you to the concepts for general educational purposes, but all information should be confirmed by an appropriate professional. To learn more, visit our disclaimers and disclosures.

Article Navigation

What is a defined benefit plan?

While you may never have heard of a defined benefit plan, you’ve likely heard of a pension plan, which is what this is.

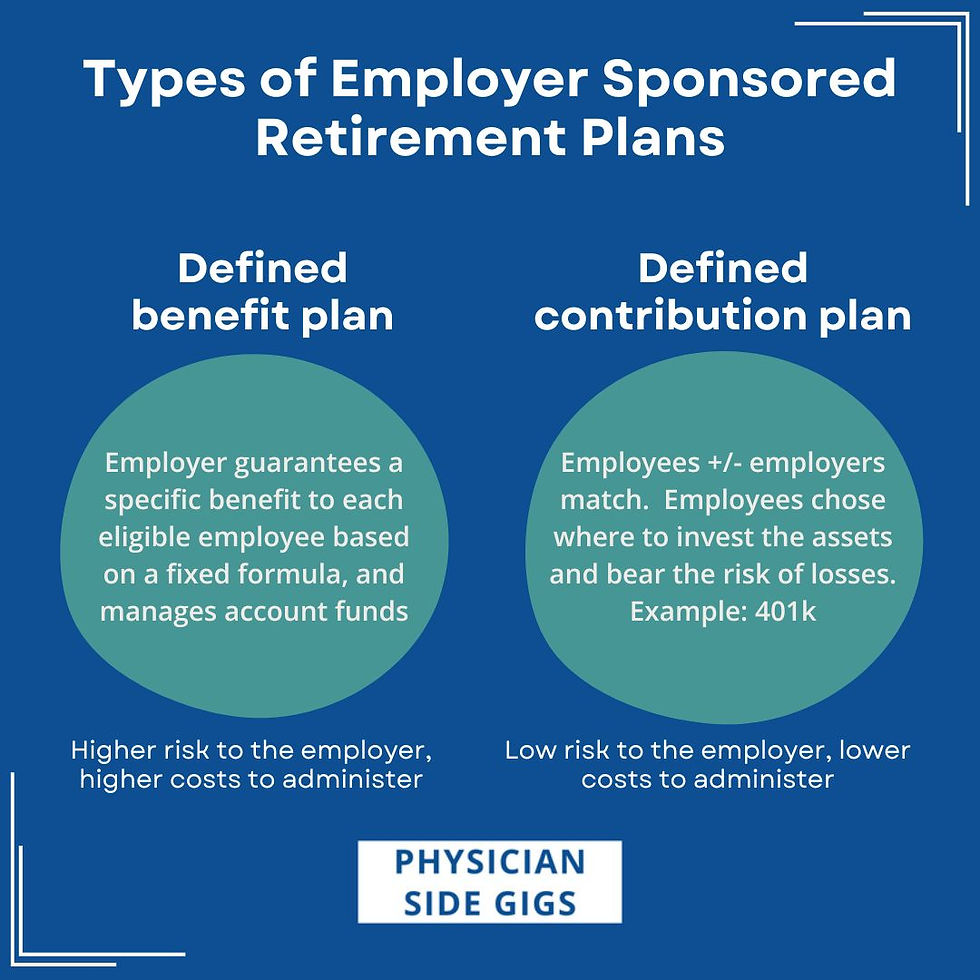

Broadly, there are two types of retirement plans offered by employers, defined contribution plans and defined benefit plans.

In a defined contribution plan, the employer provides an outlet for retirement savings to an eligible employee, but the amount that the employee will have at retirement will be dependent on both how much is contributed by the employee as well as how the account performs in terms of gains and losses. You are likely more familiar with defined contribution plans, which include 401k and 403b plans and profit sharing plans. As you know, the employee can opt in on the plan and make a contribution of their choice, up to a certain annual limit, and decide where these plan assets are invested. The employee will hopefully benefit from growth of that money (but also takes on the risk for losses). In a profit sharing plan, the employer can also make contributions.

In a defined benefit plan, however, the employer gives a specific benefit to each eligible employee at retirement, and that monetary amount is based on a fixed formula. While these are complex plans that are expensive to establish and maintain compared to the defined contribution plans, for high income businesses, they are valuable to both the employers (who may be private practice owners or yourself if you have self employed income), and the employees. The employees receive an additional fixed benefit that can be an attractive recruitment or retention incentive. The employers are able to contribute a larger amount of money to their own retirement accounts than they can in defined contribution plans as well, while also deducting the total contributions on their taxes every year.

What is a cash balance plan, and how does it work?

A cash balance plan is a specific type of defined benefit plan which is often used by private practices and self employed individuals, so we’ll focus our discussion on defined benefits plans here on this particular subtype.

In a traditional defined benefit plan, the employee’s benefit during retirement is set as a series of monthly payments for life (like an annuity).

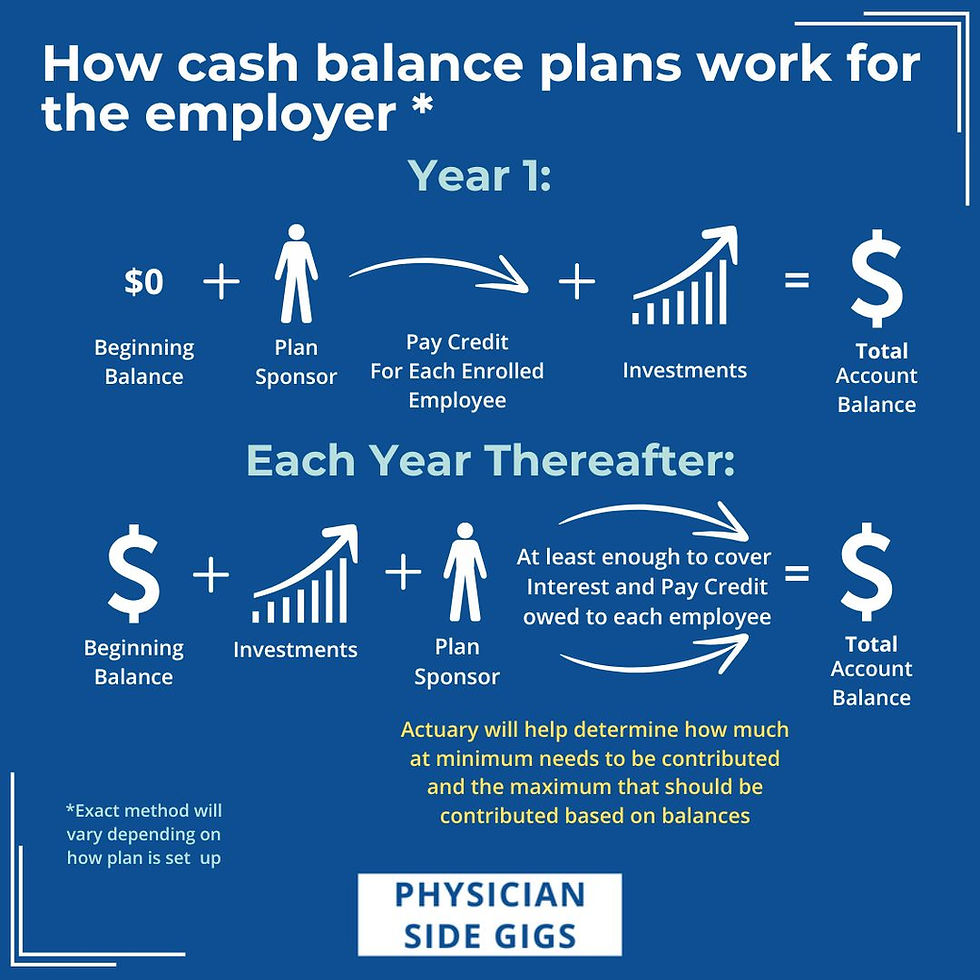

In a cash balance plan, unlike a traditional defined benefit plan, the funds within the cash balance plan can be invested and grow. Instead of like in a defined contribution plan like the 401k, the employer is the one that makes the contributions and takes on the risk of investing it, instead of the employee. They must be stewards of the account to ensure growth of the account such that it is able to pay out the promised benefits to the employees according to the plan documents. Because of this, the money is usually invested relatively conservatively. The actuary in the company running the plan will provide annual guidance on how much money is needed to fund the plan annually such that it can meet its obligations to pay the benefits promised to the employees. Swings in the value of the plan’s investments don’t directly impact the benefit the participants get, and any need to make up deficits is the responsibility of the employer.

The nice thing for the employees is that their benefit is guaranteed in retirement, and they can plan on it. They get an account balance every year that specifies the benefit amount that they have earned.

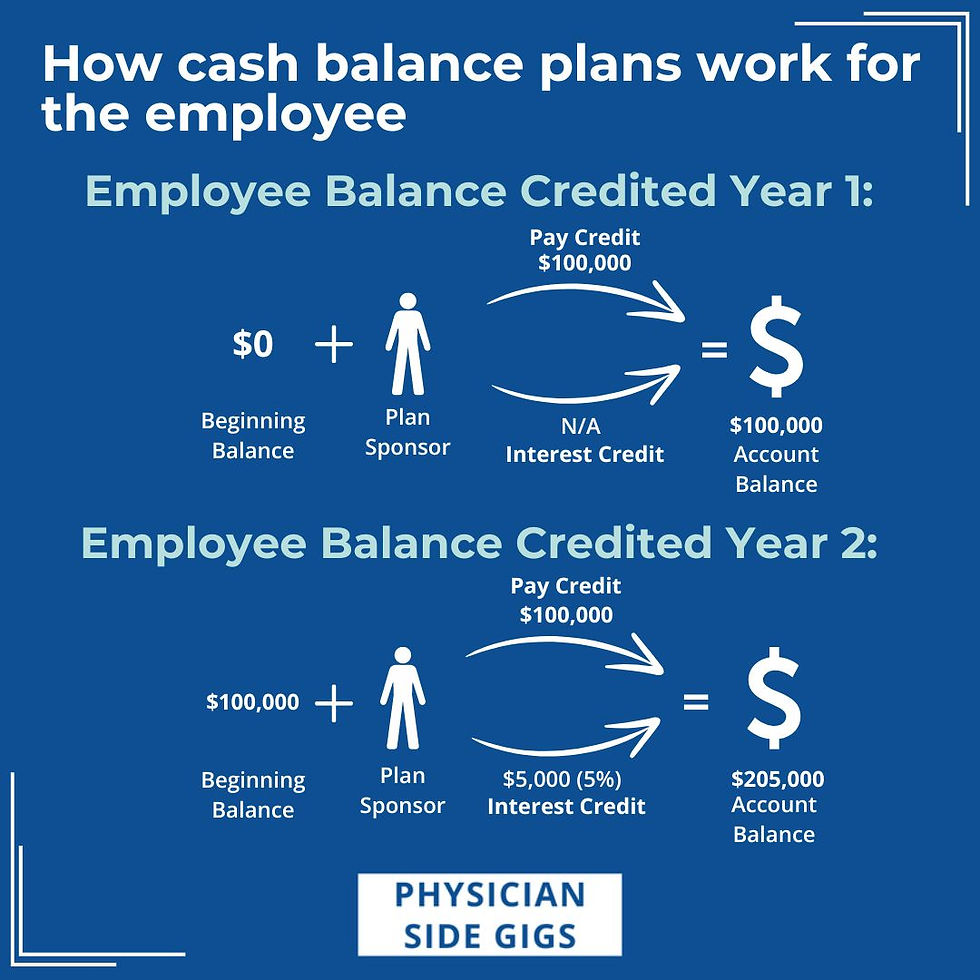

Essentially, the way this works is that each enrolled employee has a hypothetical account to which a fixed credit (the ‘pay credit’) is given annually by the employer. Additionally, there is guaranteed earned interest credit each year on their account balance. These terms are based on what the plan documents specify. The fixed amount can be determined in different ways, such as a percentage of the employee’s earnings or a fixed dollar amount. The interest amount will also be specified. Each year, the employee’s benefit will increase by that fixed amount as well as the guaranteed interest credit to create a new plan balance.

Upon retirement (or when the plan documents otherwise specify), the employee’s plan balance can be taken as a lump sum or paid out over time like an annuity, depending on what is written in the plan documents. If they take the lump sum, it can be rolled over to an IRA, where it can continue to grow tax free until the laws governing IRAs specify (including when required minimum distributions kick in).

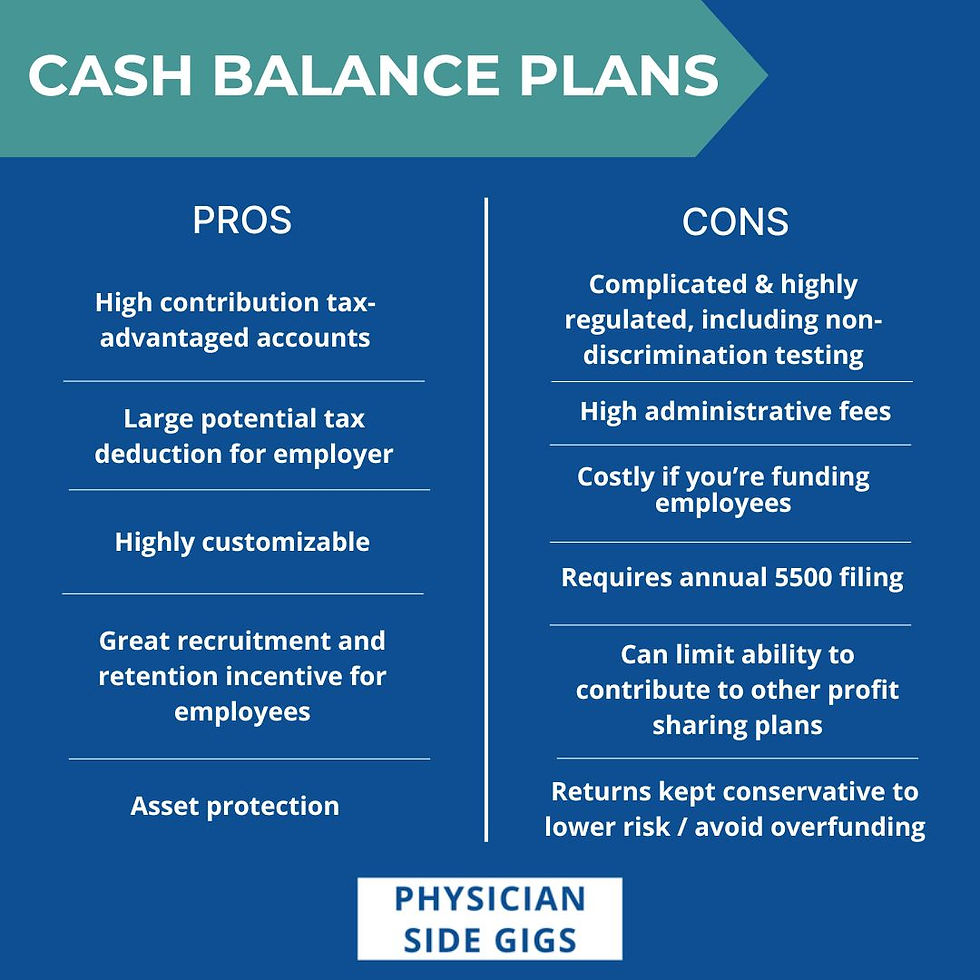

What are the pros of defined benefit cash balance plans?

You can likely already see why these are a great deal for the employee. As the employer though, whether as a private practice owner or a self employed physician, there are also many benefits. These include:

Large potential amount of money in tax advantaged accounts for the business owners. Because of the large amounts of money that you are able to contribute to these plans above other retirement plans (assuming you earn and save enough money to do so), you can accumulate substantial retirement savings in a short period of time, even if you are only running a business for a few years or are planning on retiring early. As business owners tend to have the highest salaries within a business, they tend to receive the largest contributions as well. Remember, this money grows tax-deferred until withdrawal. While there is a lifetime limit that can go into these plans, it is quite large and changes annually based on inflation. Currently, it’s at around 3 million.

Large potential tax deduction for the employer. As these are an expense to your business, they provide a large tax deduction on your tax return. Particularly if you are self employed, that will dramatically reduce your taxable income, as contributions reduce your tax liability dollar for dollar.

Flexibility in how the plan can be written. These plans are highly customizable, and can be written in the best interest of the business owners. By taking into consideration the ages of the participants, the owners of a business can also maximize tax savings and benefits to themselves, in addition to making their employees happy. Additionally, not everyone has to participate, allowing those that have the most to gain to participate while allowing those who aren’t interested in participating to opt out (subject to some rules about minimum number or % of people participating as well as staying in compliance with non-discrimination testing).

Great recruitment and retention incentive for employees. Prospective employees will consider this as part of the benefits package, making their overall compensation offer more attractive. Additionally, since these plans are customizable, they can be written to incorporate different vesting schedules ranging from immediate to spreading them out over seven years. This will aid in employee retention for those with a large potential benefit for sticking with your company.

Asset protection. These plans fall under Employee Retirement Income Security Act (ERISA) protection, which in addition to preventing dishonest practices involving retirement accounts by employers, also helps block (most) seizures of assets within retirement accounts by creditors.

What are the cons of defined benefit cash balance plans?

Complicated and highly regulated. You cannot DIY these plans. They are very complicated and require regular actuarial assessments to ensure that you are in compliance, and have complicated plan agreements that have to be regularly updated (usually every few years but if there is a major legislative or regulatory change in the interim, can be more frequent).

Costly to administer. These plans require annual payments to the company that is administering them, which typically start at a few thousand dollars a year and can be much larger depending on the number of employees.

Excise taxes will apply if you aren’t able to meet minimum contribution requirements or if excess contributions are present. This is why the actuarial work every year is so important to keep an eye on the account balance. If these plans are overfunded when the plan terminates, the amount is subject to up to a 50% excise tax, plus potentially state and federal taxes, depending on the exact circumstance of where the excess funds are going.

Subject to non-discrimination testing. All qualified retirement plans that are subject to ERISA compliance, which include defined benefit plans, require non-discrimination testing. This means that the plans are tested to ensure that they do not favor the highly compensated employees. Essentially, the government wants to ensure this isn’t just a fancy tax break for the wealthy, but is something that is to the benefit of those across the spectrum of earnings within a business. For a plan that is not for a solo physician entrepreneur with no employees, this makes things significantly more complicated, and possibly expensive enough that it may not make sense to do.

Costly to fund if also funding employees. As alluded to in the last point, in order to comply with non-discrimination testing, it may be necessary to include employees who are not contributing their money to the plan to meet the compliance and tax qualification requirements. This money will also come out of the pockets of employers/partners. The exact way this is structured with each business will depend on how the plan is set up, but there are rules about the percentage of employees that must participate in the plan, amongst other things.

Annual 5500 filing requirements. Similar to a solo 401k that has a balance of over a certain amount, an annual filing for the account is required. In this case though, an enrolled actuary must actually sign the Schedule B of Form 5500. It’s not a big deal since you already likely have one as part of the company helping you administer the plan, but it is another deadline to keep track of (typically the end of July).

Can limit your ability to contribute to the profit sharing portion of a solo 401k or profit sharing plan. There are specific rules about how much you can contribute to these accounts if you are contributing to the defined benefit plan which again will depend on the way the plan is set up.

Lower returns than if the same amount of money is invested in the stock market. While you can choose to invest the assets in a broad range of investments, this is one account that you actually don’t want to have aggressive returns on or take too much risk on. This is because the account balance every year will determine how much needs to be or can be contributed that year to ensure there is an adequate balance and that you don't overfund the plan. Overfunding the plan is problematic for at least two reasons. First, the whole point of the plan for many from a tax strategy perspective is to reduce taxable income now, so if you can't contribute, you won't get the tax deduction but will still pay all the plan administration fees. Second, you will be subject to heavy excise laws if the plan is terminated with too much money in it, which can be up to 50% of the excess amount. Therefore, this will be a conservative portion of your portfolio with targeted returns generally around 5% or whatever interest your plan is written to include.

Why is a defined benefit cash balance plan especially amazing for solo physician entrepreneurs or physicians with steady 1099 income?

The benefits of cash balance plans are especially pronounced if you own your own business which doesn’t have employees. Here, you don’t take on a lot of the complexities associated with worrying about other employees and the regulatory requirements such as ensuring ERISA compliance for a large number of employees of varying ages and incomes.

In this case, assuming you have the income to fully or at least significantly fund these plans, you can tailor the plan to make the biggest distributions possible for your age. This allows you to take a huge tax deduction on your taxes, thus dramatically reducing your taxable income for the year, as well as allows your earned money to grow in a tax advantaged way in an asset protected vehicle that offers protection from creditors.

Sure, these plans are expensive and complicated, and the DIYers in the group may be frustrated with the fees and not being able to run the plans themselves, but if you can take a six figure (or multi six figure) tax deduction, it’s hard to complain about those things with much merit.

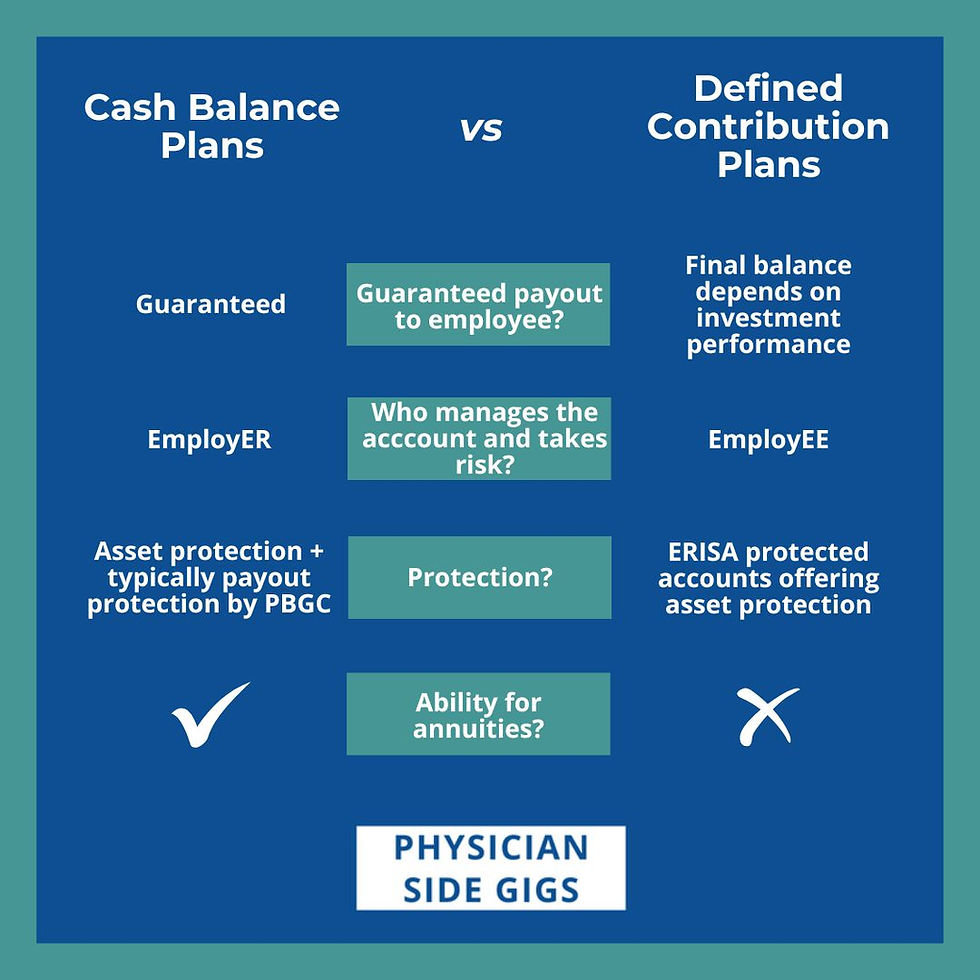

Defined benefit cash balance plans versus defined contribution retirement plans (e.g. 401k)

Because of the complexity, most people will likely only advise you to think about getting a defined benefit cash balance plan if you are already maximizing your les complicated and less expensive defined contribution plans, such as a 401k, and still have a significant amount of money you'd like to invest in a tax advantaged way and get a corresponding tax deduction. If you're not going to be able to do that because you need the rest of your income or if you're not making enough income to make larger contributions, it likely doesn't make sense.

Let’s compare some other differences between the two that may impact your decision:

Participation requirements: Defined contribution plans depend in part on an employee electing a contribution to the plan. Cash balance plans don’t usually require this of their employees.

Who takes the risk in investing: With defined benefit plans, the employER takes the risk, even if they use a third party investment manager to manage the funds. If they lose money, they will have to contribute more in order to ensure the benefits of the employees remain guaranteed. 401ks usually allow the employEE to pick where things are invested, and if the employees choose something that loses money, that’s on them.

Federal protection: While many retirement plans offer some form of asset protection, pension plans such as defined benefit plans are eligible for another layer of protection. These plans are typically insured by the Pension Benefit Guaranty Corporation (PBGC), which means that if for some reason the plan has to shut down and doesn’t have the money to pay what it has promised employees, the PBGC will take over the plan and pay pension benefits.

Ability for annuities: Defined benefit cash balance plans require that the employees are able to get lifetime annuities if they opt for this instead of cashing out a lump sum amount.

Who can establish a defined benefit cash balance plan, and what kinds of regulatory and federal requirements are there?

There are a lot of requirements, and it would be difficult to make a comprehensive list as these are so customizable. However, in general:

Any business can typically establish this plan, so long as they have enough willing participants to meet the regulatory requirements and feel confident that they can continue to provide benefits for several years. It is not possible to decrease benefits once you have established the plan, and shutting down the plan too early will raise eyebrows with the IRS, who is very wary of people trying to use these for tax deductions instead of truly as a pension plan.

You can have these in addition to other retirement plans, but the contributions to the defined benefit plan can limit the contributions you can make to the defined contribution plans.

You typically need to use an outside company to administer this plan and keep it in compliance, as you need an enrolled actuary to tell you how much needs to or can be funded each year as well as sign off on your annual Form 5500 filing.

The plans are also highly subject to federal law, including need to stay compliant with the Employee Retirement Income Security Act (ERISA), the Internal Revenue Code (IRC), and the Age Discrimination in Employment Act (ADEA). You are required to serve in a fiduciary capacity, and there are rules set within each plan for participation, vesting, benefit accrual, funding, communication requirements with plan participants, making the plan eligibility compliant with IRC rules, and more. Non-discrimination testing regulations are strict, and are not forgiving about mistakes, with heavy penalties and costs associated with running afoul of them.

Agencies involved in enforcement include the IRS, Department of the Treasury, the Department of Labor, and the EEOC (Equal Employment Opportunity Commission). Essentially, you don’t want to do anything to run afoul of these policies.

Conclusion

This article only scratches the surface of the nuances of these very complicated plans, but hopefully gives you enough information to know whether you want to learn more and potentially explore using the defined benefit cash balance plan for your private practice or side business. It is a powerful tax strategy tool and can allow you to put much larger amounts of money into tax advantaged accounts than normal retirement plans, and though complicated and costly, this alone may be worth exploring it further.

As always, remember that we are not accountants, actuaries, or otherwise licensed to provide official information on defined benefit plans. Please consult a licensed professional before making any decisions based on this information, which is purely for educational purposes and just designed to give you an overview of these plans.

Resources

If you’re unsure of the best way to capitalize on tax strategy, we suggest working with a financial advisor for physicians to help with your overall investment strategy. A robo-advisor can also be a useful tool, as many are meant to help tax loss harvest as part of their overall investing strategy.

Want to learn more about investing for physicians? Check out these other resources on our website: