How to Vet Opportunities to Invest In Startups Via Angel Investments or Venture Capital

- Nisha Mehta, MD

- Sep 21, 2024

- 7 min read

Updated: Nov 19, 2024

Startups are all the rage these days, and many physicians have been bit by the venture capital or angel investment bug. However, as the space grows, founders are also becoming more savvy, with entrepreneurial programs and mentors teaching them how to effectively make pitches that can make almost any investment opportunity sound like a good one. Given that only a small percentage of startups succeed, it’s important to understand what factors to consider when vetting a potential opportunity to invest in a startup. Below, we’ll go into the types of questions and considerations that those in the space will regularly use to decide whether or not they want to invest in a early stage company.

Disclaimer: Please do your own due diligence before making decisions based on this page. Nothing on this page constitutes formal or personalized financial or legal advice. Our content is for generalized educational purposes. While we try to ensure it is accurate and updated, we cannot guarantee it. We are not formal financial, legal, or tax professionals, and you should consult these as appropriate. To learn more, visit our disclaimers and disclosures.

Article Navigation

What is startup investing?

Put simply, early stage startup companies need capital to develop out their ideas, go to market, and scale. At various stages along their growth, they will typically raise multiple rounds of funding to take their company to the next level. Angel investors and venture capital companies can jump in as investors throughout this process depending on where their niche is. Some venture capital companies get involved at very early stages, whereas others prefer to invest only after a company has gained significant traction. Regardless, as a physician, if you are being asked to invest in a venture capital fund or in an individual investment as an angel investor or through another vehicle such as an SPV, you want to know what questions to ask.

Learn more about the difference between investing in startups via venture capital and angel investing.

Why invest in startups, and what are the pros and cons?

There are lots of reasons to invest in startups, including the potential for large returns on your investment, the ability to partake in innovation and bring products you believe in to the market, and the ability to diversify your investment portfolio and your networks.

On the flip side, it’s important to know that most startups do fail, and the chances that you pick a winner that has a big IPO are slim. You should only invest money you can afford to lose and that you don’t need access to. These are illiquid assets that can take years to even over a decade to pan out with a return, even if a company is crushing it.

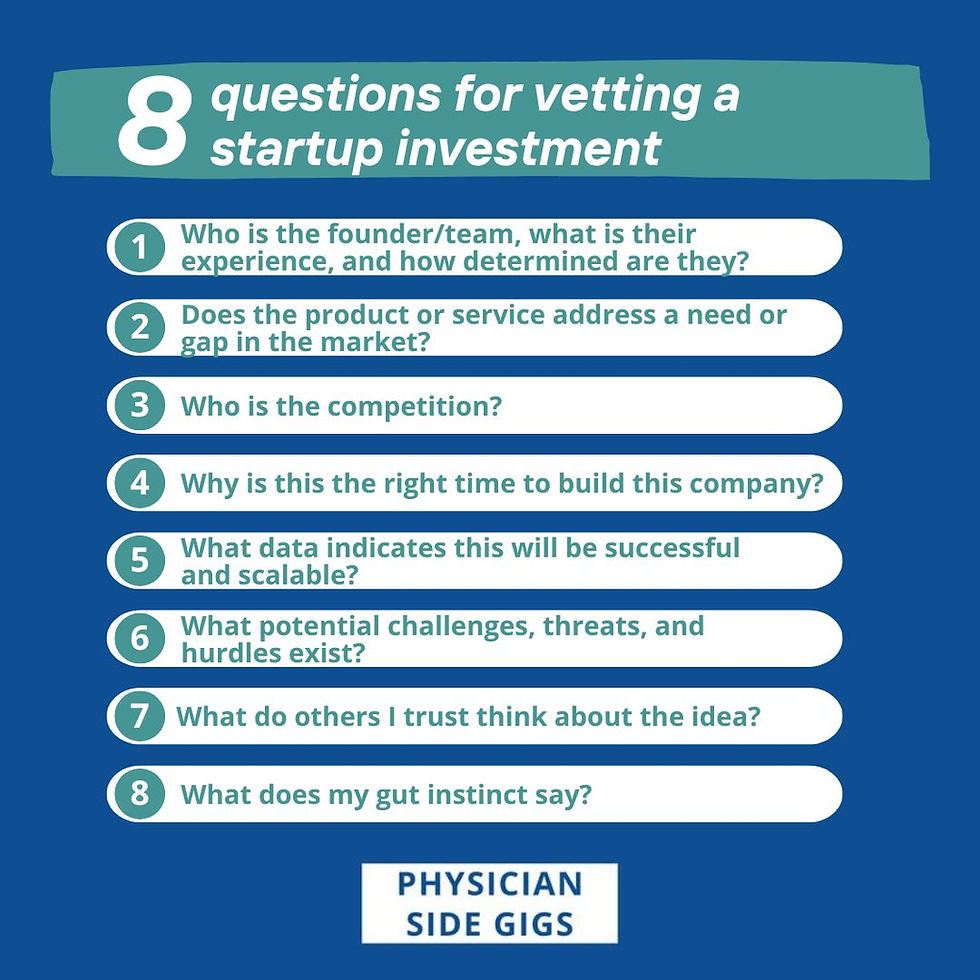

Questions to ask when vetting an opportunity to be an investor in a startup

Who is the founder or the team, and what is their experience?

You want to believe in the founder and the team. This is both on a personal and professional level. Angel investing requires a good amount of trust that the founder will do right by you, so you want to believe they will stay true to their word.

What experience does this founder or team have that supports their ability to bring this product or service to fruition? Have they had successful exits in the past? Are they uniquely positioned to have connections in the space that set them apart from others innovating in the space and who can ensure their product is a success?

Also, how badly do they want or need this to work out? You want your founders to be willing to get deep in the weeds on the hard work that needs to be done at the ground level to build a company, and to want it badly enough that they’ll soldier on through the challenges of building a startup. While somebody may have a great track record, if they’re not motivated to do everything possible to make this successful, the company will suffer for it.

Does the product or service address a true need or gap in the existing market?

In order for a product or service to succeed, it needs to be in demand. In order for it to be in demand, it needs to address a problem that potential customers or buyers have.

Who is the competition, both existing and in the future?

How many others are building in this space, and what unique advantages does this company have that will give it a competitive edge over the other competitors? If there is no competition, why is that? Have others already tried this business model and showed that it had fatal flaws? What is the likelihood that this company can build faster or build a better product than other solutions in existence or in the pipeline?

Why is this the right time to build this company?

The founder is probably not the first person to think of this problem or solution. Why is it that they are going to be successful when others haven’t, or that people are going to buy it now when they haven’t bought it in the past? Is there a unique timing right now that makes the market more amenable to adaptation? This is called the “Why Now?” and you’ll hear lots of investors refer to that.

What data indicates that this idea will be successful and scalable?

In order for a company to grow, there are many things that have to come together with product market fit and supply and demand. What market research has the founder done to prove that people will purchase this product or service? Have they launched a beta version and how has it done? What has been the track record of similar companies in the space?

Also, while many companies can be profitable, is this company scalable? What is the total addressable market of potential customers? Does the business model lend itself to increasing efficiency and cost effectiveness that allows it to scale and generate exponential growth and returns? Does it have recurring revenue streams, or do they have to always rely on new customer acquisition?

Are there a lot of people already on the waitlist for this product? Are there already a lot of users in beta mode? While some companies may be too early stage to have actual customers or even an existing product, do they have companies or buyers who have already expressed interest in the product? Have they already successfully tested one market, and have the potential to scale into other regional markets or customer demographics?

What potential challenges or threats do you need to be aware of?

Will this company need to make it through a regulatory body that is unpredictable? How long is the process to go to market and what potential hurdles exist, especially those that may be insurmountable? Good founders won’t just tell you the potential benefits to their investment but also the risks. If they don’t think there are any challenges or won’t talk about them openly, view that as a major red flag. Even if they aren’t maliciously omitting information, it could be a sign that they are too optimistic and don’t have a healthy dose of practicality and realism.

What do others that I trust think about the idea?

While you may have signed a non-disclosure agreement that limits you from sharing too much detail about an angel investment opportunity, you can still ask general questions to trusted people in the space. Most investors have networks that they run things by or people with expertise in a certain product area that allow them to dig deeper into potential challenges or give them a greater understanding of the market for a product. In fact, many venture capital or private equity companies that use our physician consulting network are looking to pick the brains of physicians for exactly this reason.

Gut instinct

Lastly, you want to listen to the spidey sense you have. Especially if you routinely vet investment opportunities, you’ll develop an intuition about opportunities. Pay attention to that, as it’ll cover lots of intangible aspects of the vetting process you may not think to ask in the moment. Dig deeper into why you get a certain sense off the bat that you want to learn more, or that you should stay away even if a pitch looks great on paper or on delivery.

How do you hear about opportunities to invest in startups?

Different physicians get involved in startup investing by different means, and most times aren’t even actively looking to get involved in the space when they’re first introduced to it. You may hear about an opportunity through word of mouth through your professional network, through a crowdfunding site, through an angel or investment group, or by being offered the opportunity to invest in a venture capital fund or special purpose vehicle (SPV).

Other general tips for investing in startups

As you dip your toes into this space, here are some other helpful tips.

Invest only in products or industries you understand.

Invest in things that excite you.

Diversify your portfolio across different industries and product types.

Make sure you understand the actual investment terms and conditions, including what types of shares you own and if they come with voting rights or can be diluted.

Network widely and find mentors in the space.

Always do your own due diligence instead of trusting the word of others that something is a good investment.

You can read about all these points in more detail on our article on getting started with angel investing.

Conclusion

Investing in startups is exciting and fun, but you also want to make sure that you do your due diligence. It’s important to weed out the pitch hype from the actual likelihood that a company will succeed. Asking careful questions, paying attention to how they’re answered, getting to know the founder and their team, and talking to your own networks will give you lots of insight as to whether or not you should consider going forward.

Additional resources for doctors interested in the startup world

Learn more about:

Sign up for our free entrepreneurship and health tech educational events and watch replays of past events.