Guide to Life Insurance for Physicians

(Types of life insurance, where to buy it & how much you need)

Life insurance and disability insurance are often discussed as first steps in basic personal finance for physicians, particularly at earlier stages of their careers. Most physicians who have dependents that rely on their income to maintain their lifestyle want to ensure that if something happened to them, their families would be able to maintain their standard of living. Life insurance is a critical tool for this, but it can be confusing to navigate what products to buy and how much life insurance you need. This page is intended to give you resources to buy life insurance, as well as answer FAQs we often see on the groups.

Disclosure/Disclaimer: This page contains information about our sponsors and/or affiliate links, which support us monetarily at no cost to you. These should be viewed as introductions rather than formal recommendations. Our content is for generalized educational purposes. While we try to ensure it is accurate and updated, we cannot guarantee it. We are not formal financial, legal, or tax professionals and do not provide individualized advice specific to your situation. You should consult these as appropriate and/or do your own due diligence before making decisions based on this page. To learn more, visit our disclaimers and disclosures.

Quick Links

-

-

Do I Need Life Insurance?

-

-

-

How Much Life Insurance Should I Get?

-

How Much Will It Cost?

-

Laddering Life Insurance Polices to Save on Premiums

-

Where to Buy Life Insurance

Using a broker who can run rates across multiple companies and help you navigate your options is generally a good idea, as it doesn't cost you anything to use them. They are paid by the insurance company you ultimately choose. You may be comfortable just talking to one company, or you may want to run a few quotes to feel confident in your decision. Generally, the difference in prices will reflect which discounts each company has access to. These are our sponsors/advertising affiliates, who 1000s of members of our groups have used and said positive things about.

PolicyGenius: PG is well known in the insurance space, and are a very convenient way to shop for life insurance as they will run rates across the major companies online within minutes, and then get on the phone with you to discuss your options. Contact them here.

Pattern: This option will allow you to enter your information and immediately begin generating quotes, as well as schedule a meeting with the great team at Pattern to discuss the options and figure out which plan is best for you. Contact them here.

Moment Insurance: Complete your quote inquiry information in less than five minutes and easily schedule an appointment to speak with a dedicated, experienced life insurance expert who will walk you through the process from start to finish and help you compare different options. Many in the group have worked with their experts previously, and had a great experience! Contact them here.

Introduction

A life insurance policy is essentially a contract between the insured and an insurance company that guarantees that the insurance company will pay the beneficiaries of the insured the agreed amount of money (the death benefit) if the insured person passes away during a specified period (term life insurance) or when the insured person passes away, regardless of when they pass away (permanent life insurance), as long as the insured pays their premiums in accordance with the contract.

For term life insurance, you pay a premium for a death benefit, which is amount of money paid out if you pass away during the term.

With permanent life insurance, you pay a premium for a death benefit, same as a term policy, but there is also a cash value component, which is a savings account that can be used during your lifetime (but any outstanding loans at the time of death will reduce your tax benefit). This cash value portion remains with the insurance company at the time of death.

Do All Doctors Need Life Insurance?

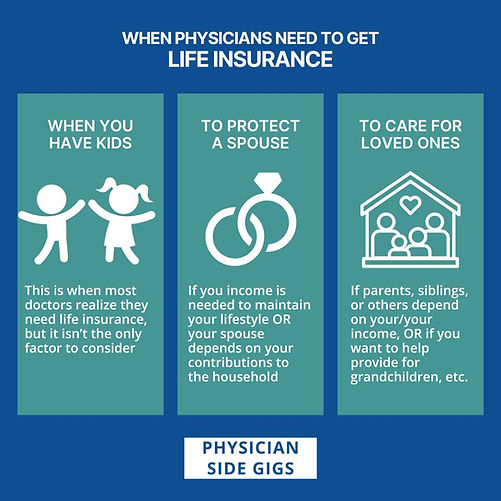

Whether you need life insurance depends on a few things.

First, do you have people that depend on your income to provide the life that you want for them (spouse, children, parents, etc.)?

If yes, assess whether your current net worth/assets would be enough to cover the expenses that you would want covered in their absence. If not, it's worth looking into life insurance.

If not, different people have different feelings on this. As a general rule, the earlier you buy, the younger and healthier you’ll be, so the cheaper your policy will be, so if you anticipate needing it later, you may want to buy. This will also ensure that an interim medical condition doesn't preclude you from qualifying for insurance. On the flip side, the incremental income in premium may not be outweighed by years of not paying for a policy. Of course, if something happens to you in the interim, you may regret not having purchased. Some people lock on a basic policy early, and then get more later as needed.

Also consider if there is an estate planning reason to consider a permanent life insurance product. In general, mixing insurance and investing is not recommended—we cover this in more detail on our Should Physicians Buy Whole Life Insurance? page. However, we discuss below the exceptions to this rule.

Learn more about when doctors should get life insurance.

My Employer Offers a Life Insurance Plan. Do I Need My Own?

Yes, and there are a few reasons why.

Job Change

You could change jobs (and statistically, you likely will). You don't want to take a chance you won't qualify for an individual policy at that time (or that it is much more expensive because you're older) or that the new job's policy is not good.

Pricing

If you are young and healthy, you will likely qualify for a much better benefit on the private market than you will for the same price with your employer's policy, as it is underwritten to the mean. In general, many physicians also want more coverage than that offered through their employers.

Types of Life Insurance

Term Life Insurance

This is what most people, doctors included, need. It is cheap and covers your need to insurance against financial catastrophe for your heirs in the event of your demise.

Term policies last for a predefined number of years (commonly 10, 20, or 30). They only pay out if you pass away during that time. There is no residual value once the term has expired.

A few special types:

-

Decreasing term: renewable with coverage decreasing over the life of a policy at a predetermined rate

-

Convertible term: can covert to permanent life insurance

-

Renewable term: renewable, premiums increase annually

Permanent Life Insurance

With permanent life insurance, your benefit stays in place for your entire life unless you stop paying premiums or surrender the policy. These policies are more expensive than term policies and are usually more complicated.

These policies are often pushed by insurance salespeople because they generate a large commission for the person selling them, but for the vast majority of physicians, they don't make financial sense. The reasons they will generally give are that these policies have cash value you can borrow against, you can avoid estate taxes to your heirs, and the life insurance plan is asset protected and shielded from liability.

It is usually better not to mix insurance and investing. Given how much more expensive the premiums are than term life, if you invest the difference in the premiums in the market and get historical stock market returns over the low returns and high fees on the cash balance portion of your plan, you will generally come out significantly ahead.

We recommend only considering permanent life insurance after consulting non-biased expertise that doesn't profit from you buying the product. They may recommend it for estate planning considerations. Read more about that in our physician estate planning guide.

Types of Permanent Life Insurance

Whole life: accumulates cash value, which can be used to borrow against or to pay premiums. Learn more about whole life insurance policies in our physician guide to whole life insurance.

Universal life: has a cash value component that accumulates interest. Flexible and can be adjusted or designed to have a level death benefit or an increasing death benefit.

Indexed universal: gives you a fixed or equity indexed rate of return on the cash value component.

Variable universal: allows you the ability to invest the policy's cash value in a separate account. Flexible and can be adjusted or designed to have a level death benefit or an increasing death benefit.

Key Differences Between Whole Life and Universal Life

-

Whole life - fixed premiums, guaranteed death benefit, cash value while you're living, guaranteed dividends, higher premiums, can never become underfunded.

-

Universal life - flexible premiums, may allow you to increase or decrease death benefits, offers cash value potential, interest rates can change over time, lower premiums than whole life, may become underfunded or lapse.

Learn more about the different types of permanent life insurance.

Investing Through Life Insurance Products

Insurance agents and brokers will often pitch high-commission insurance products to high-income earners like doctors as a saavy investing hack. These are generally not a great investment strategy for the vast majority of physicians.

Learn more about better alternatives for investing on our commonly used types of investments and strategies for physicians page.

Life Insurance Coverage Specifics

How Much Life Insurance Should I Get?

To determine how much life insurance coverage you should get, assess the following:

-

How much money does your family spend annually?

-

How much debt do you have that will not be discharged on your death (student loans may be discharged, mortgage will not)?

-

How much do you have in savings, and how much is readily accessible/easy to liquidate?

-

What do you want to provide your family with (do you want to pay for college, do you want them to stay in the same house or are you okay with them having to decrease expenses or work more, etc.)?

When determining your policy amount, also account for lifestyle inflation and potential increase in expenses if childcare or other costs would increase. If you have employer or social security benefits, factor those in as well.

Learn more: How Much Life Insurance Coverage Do I Need As A Physician?

You should regularly reassess your life insurance needs and adjust based on interim savings, major life events like marriage or the birth of a child, and how much remaining debt you have. Typically, your need for life insurance will decrease over time as you accumulate a larger nest egg and life’s expenses decrease as your children get older, but every family’s situation is different.

How Much Will a Life Insurance Policy Cost?

Policy premiums depend on many factors, including:

-

Gender (men typically pay more)

-

Age

-

Amount of Coverage

-

Health Status - medical history, family history, ongoing medical problems

-

Occupational hazards

-

High Risk Activities (smoking, certain hobbies, driving record)

-

Riders applied to policy

The general rule of thumb is that term life insurance should be relatively cheap compared to disability insurance for physicians. Term life insurance will also be much cheaper than permanent life insurance.

What Does the Shopping Process Entail?

When looking at policies, shop around with multiple life insurance companies for physicians!

While some policies don't require a medical exam, most will.

You will be required to fill out an application that discloses your past and current medical history as well as family history and certain high risk activities. It is important to be truthful during this application process, as if the company finds out that you were not, they may not be obligated to payout at the time of your passing.

You can pick a policy where premiums are stable or start out cheaper and get more expensive over time. You should judge how quickly you expect to achieve financial stability when making this decision.

Laddering Life Insurance Policies

Laddering policies can be a savvy way to not overpay for coverage you won't need later in life but that you need currently. Your rates for a large policy for 30 years for example, are going to be very high.

For example: Let's say you need 5 million in life insurance right now because you have very 4 young children who will need support for the next two decades, a large mortgage, and not much in savings. In 10 years though, with your salary, you anticipate that your mortgage will be paid off and there will be one less decade of support for your children necessary. In 20 years, you anticipate you will have much more in savings and much less in support necessary for your children, but would want to leave a small policy to cover any expenses at the time of your death without having to liquidate assets, as well as some residual support for your spouse.

In this case, it may make sense to buy a 10 year policy for 2 million, and a separate 20 year policy for 2 million, and a separate 30 year policy for 1 million. This is much cheaper than buying a $5 million dollar policy for 30 years.

If you pass away within the first 10 years, your beneficiaries will inherit 5 million. If you pass away between 10-20 years, they will inherit 3 million. If you pass away within 20-30 years, they will inherit 1 million.

Learn more on our laddering life insurances policies page.

Special Circumstances

Estate Planning

Sometimes, life insurance plans are useful for estate planning considerations, such as:

-

Special needs child where you want to ensure there will be funds available for long term care of a disabled adult child regardless of when you pass on.

-

Passing down your wealth through a life insurance plan is exempt from estate tax thresholds. In the rare instance where a physician's estate exceeds the current estate tax limitations of $12.06 million for one person ($24.12 million for a couple), this could be a powerful way to avoid a heavy estate tax.

Learn more on our physician estate planning guide.

The decision to use life insurance for these reasons should be made only after consulting appropriate legal and accounting advice from someone that doesn't benefit from your purchase of the policy.

What Happens If the Company I Choose Goes Bankrupt?

Life insurance policies are actually very heavily regulated. There are built-in protections that safeguard consumers, and companies are legally required to keep a specified amount of cash reserves on hand to pay out death benefits in a worst-case scenario. Additionally there are reinsurance requirements that require the insurance companies to have insurance, such that the risk is spread out over several companies. They also have mandatory membership in guaranty associations which protect your policy if a provider does declare bankruptcy. such that your policy would get transferred to another association. Of note the guaranty association death benefit is capped, and the amount may vary based on state. All of that said, insurance company bankruptcies are very rare and no insurance companies have declared bankruptcy since 2008. To be safe, obviously try and research the financial health of an insurer through credit agencies (A.M. Best, Standard and Poor's, Moody's) before you buy a policy, but this is generally not a concern.

Other Tips

Even if your spouse is not bringing in a paycheck, you should generally get a policy for them. Chances are their being at home saves you money in childcare, cooking, etc, or you may choose to cut back yourself, and you don't want to have to worry about finances.

When in doubt, don't skimp on term life insurance. It is relatively cheap and you never know what your circumstances or desires will be in a major life changing event. You don't want finances to be what dictates the decision.

"No-exam" policies exist, but they usually cost more and have a lower death benefit. Consider this option if you think your lab work may cause issues in the underwriting process, and don't be afraid to ask your agent for their opinion prior to applying.

Canceling Your Life Insurance Policy

When should you cancel your life insurance policy? Once you've reached financial stability and savings to the point where you no longer need to worry about your heirs' not having the money necessary to have the life you want for them.

It is not complicated to cancel - you can literally just stop paying at the time of annual renewal.